When it comes to securing Point-of-Sale (POS) systems, encryption and tokenization are two powerful tools that protect sensitive customer data like payment details. Here’s what you need to know:

- Encryption converts readable data into scrambled code, making it unusable without a decryption key. It secures data both in transit and at rest.

- Tokenization replaces sensitive data with a random token, removing the original data from your system and reducing exposure risks.

Both methods help prevent breaches, protect customer trust, and simplify compliance with standards like PCI DSS. Choosing the right approach depends on your business needs, but combining them often delivers the best results.

Key Takeaways:

- Use encryption for securing data during transmission and when processing the original data is necessary.

- Opt for tokenization to store sensitive data securely and reduce compliance scope.

- Regular updates, proper key management, and secure token vaults are critical for maintaining security.

Keep your POS systems secure by implementing these practices, staying compliant, and investing in robust tools like MerchantWorld’s solutions, which integrate both encryption and tokenization seamlessly.

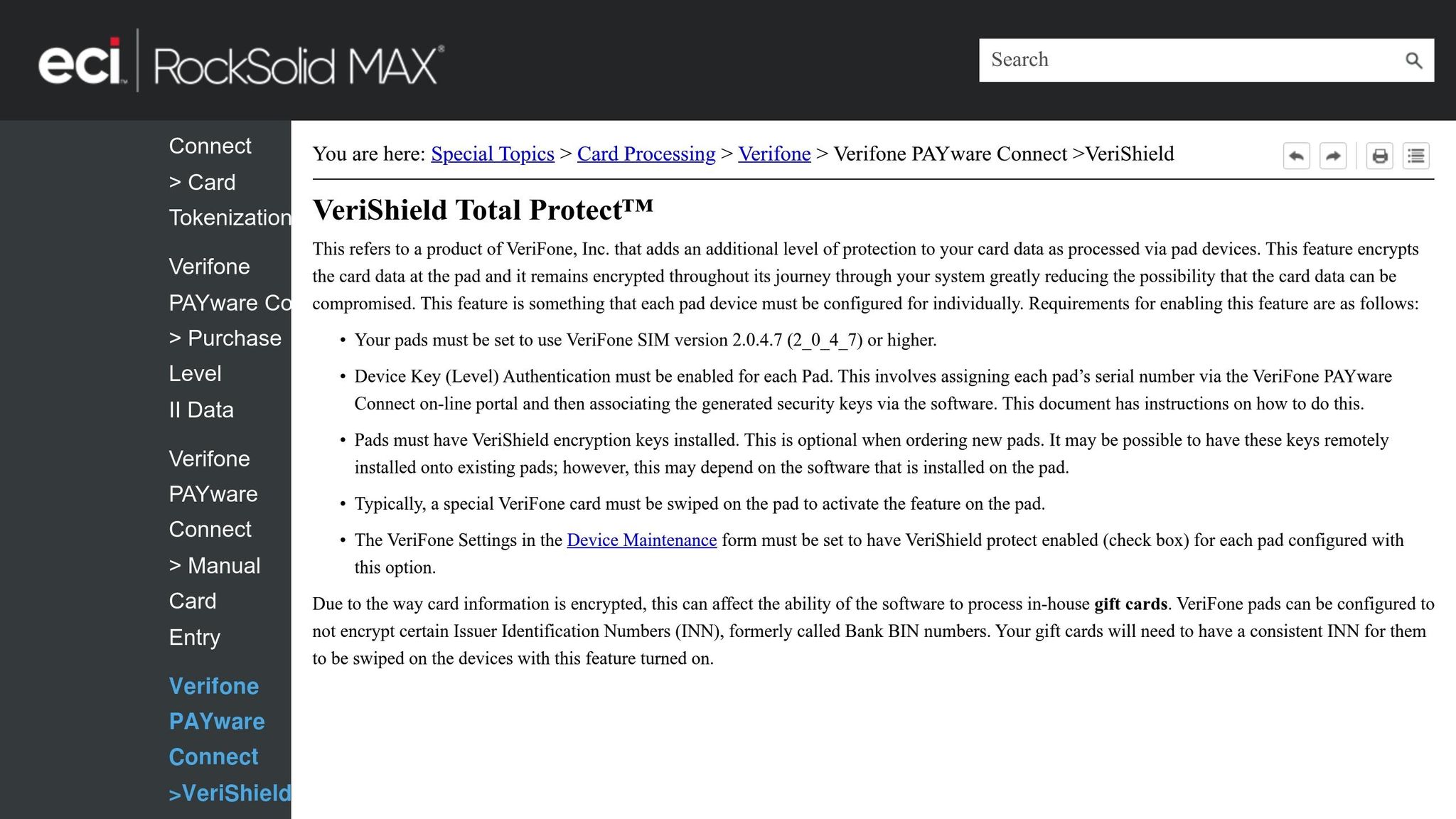

VeriShield Total Protect

How to Implement Encryption in POS Systems

Encryption is a critical layer of security for POS systems, safeguarding cardholder data throughout the payment process. By encrypting data at every stage, you can protect sensitive information from being intercepted or misused.

End-to-End Encryption (E2EE) for Secure Transactions

End-to-end encryption (E2EE) creates a secure pathway for payment data, ensuring it remains protected from the moment it’s captured until it reaches the payment processor. With E2EE, even if hackers intercept the data, all they’ll see is scrambled, unreadable information.

Here’s how it works: payment terminals encrypt data as soon as it’s captured using strong algorithms. This encrypted data is then transmitted securely – never in its original, readable form. Because the POS system only handles encrypted data, the risk of exposing sensitive information is significantly reduced. Even if someone gains unauthorized access to your POS system, they won’t be able to extract usable payment details.

To implement E2EE effectively, you’ll need both hardware and software that support encryption. Your payment terminals must encrypt data at the point of capture, and your payment processor must handle encrypted data streams. While most modern POS systems come with E2EE capabilities, it’s essential to confirm that all components in your payment chain are compatible with this technology.

Another key factor is secure network configuration. For E2EE to work optimally, you’ll need secure communication protocols like TLS 1.2 or higher to protect encrypted data during transmission. Additionally, managing encryption keys properly is crucial for maintaining strong encryption.

Managing Encryption Keys Properly

No matter how strong your encryption is, poor key management can undermine its effectiveness. Proper key management ensures that encryption remains secure and reliable.

A centralized key management system is vital for maintaining control over your encryption keys. Instead of managing keys individually across different locations or terminals, a centralized system allows you to oversee key generation, distribution, and rotation from a single point. This reduces the risk of human error and ensures consistent security policies across your entire POS network.

To further secure your keys, use key-encrypting keys (KEKs) and enforce dual control mechanisms. This means no single person has full access to the key management system, reducing the risk of unauthorized access. As outlined in NIST SP 800-57 part 1, rev. 5:

"Ultimately, the security of information protected by cryptography directly depends on the strength of the keys, the effectiveness of cryptographic mechanisms and protocols associated with the keys, and the protection provided to the keys. Secret and private keys need to be protected against unauthorized disclosure, and all keys need to be protected against modification."

Regular key rotation is another important practice. By updating encryption keys periodically, you limit the damage that could occur if a key is compromised. Many experts recommend rotating keys at least once a year, though high-risk environments may require more frequent updates. Automated key management systems can handle this process efficiently, reducing manual effort while maintaining security.

Lastly, establish backup and recovery procedures for your encryption keys. Losing access to your keys could mean losing access to your encrypted data entirely. Store backup copies of keys in secure, geographically distributed locations, and regularly test your recovery processes to ensure they work when needed.

Regular Updates and Compliance

Encryption isn’t a one-and-done solution – it requires ongoing maintenance to stay effective. Regular updates and compliance with industry standards are essential for keeping your POS system secure.

PCI DSS 4.0 compliance is the benchmark for payment card security, with new requirements set to take effect by March 31, 2025. This standard emphasizes strong encryption for both stored and transmitted cardholder data, as well as robust key management and security testing. According to Christopher Strand, Strategic Advisor at Thoropass:

"PCI will state that 4.0 is the biggest change to PCI in a long time. It’s one of the biggest releases of the standard in a while."

Keeping up with these changes means reviewing your encryption practices to ensure they align with the updated guidelines.

Vulnerability management is also critical as cyber threats continue to evolve. In 2022, the Internet Crime Complaint Center (IC3) reported nearly 801,000 cybercrime incidents, resulting in over $10.3 billion in financial losses. Regular vulnerability scans and penetration tests can help identify weak points in your encryption setup before attackers can exploit them.

Automation can play a big role here. As Robert Gormisky, Information Security Lead at Forage, explains:

"You really want to increase the frequency on which you’re doing some of these activities. What that means from a technology perspective is that you’re going to want to look for tools that allow you to automate things more and more."

Automating key rotation and monitoring minimizes vulnerabilities while reducing the administrative workload.

Finally, don’t overlook software updates and patches. Many cyberattacks target known vulnerabilities in outdated systems, so keeping your POS software and hardware up to date is one of the simplest yet most effective defenses. Establish a routine update schedule to ensure all components in your payment processing chain are protected.

Documentation and audit trails are equally important. Maintaining detailed records of your encryption setup, key management processes, and security tests not only supports compliance audits but also helps you identify areas for improvement. Over time, these records can provide valuable insights for strengthening your overall security strategy.

How to Implement Tokenization in POS Systems

Tokenization replaces sensitive data with tokens, effectively minimizing exposure risks. By doing so, it not only reduces security vulnerabilities but also simplifies compliance with regulatory requirements. From the moment data is captured, tokenization ensures a safer path forward for handling sensitive information.

Reducing Sensitive Data Exposure

At its core, tokenization replaces sensitive details – like credit card numbers – with unique, random tokens that hold no value outside the system. For instance, when a customer swipes their card at a POS terminal, the real card number is immediately swapped out for a token. This token acts as a stand-in for future transactions, while the original card data is securely stored off-site.

What makes this system so effective is that these tokens are useless to hackers. Even if a breach occurs, the stolen data is just a string of meaningless characters, incapable of being used for fraud or identity theft. This approach significantly limits the fallout from potential data breaches.

Tokenization is versatile, supporting multiple payment scenarios. Whether it’s recurring subscription billing, one-click online purchases, or securely storing payment details for future use, tokenization fits seamlessly. Mobile wallets like Apple Pay and Google Pay also rely on tokenization to enable secure, contactless payments. With its growing adoption, analysts predict tokenization will be used by 80% of enterprises by 2025, up from 65% in 2023.

Securing Token Vaults

While tokenization reduces exposure, the security of the token vault – the database that maps tokens to the original sensitive data – is paramount. These vaults, typically managed off-site by certified providers, ensure that even if your POS system is compromised, the actual payment information remains secure.

Selecting a trusted tokenization provider is key. Look for providers that implement robust security measures, such as strong encryption, strict access controls, and continuous monitoring for suspicious activities. Role-based access controls can further enhance security by ensuring only authorized personnel can access tokenized data.

Real-time monitoring and logging add another layer of protection, making it easier to detect unusual activity quickly. Regular security audits, including vulnerability scans and penetration tests, help identify weaknesses before they can be exploited. For businesses managing their own token storage, encrypted backups stored securely off-site are essential to protect against cyberattacks and physical disasters.

Token Generation and Management

A strong tokenization system relies on secure token generation and effective lifecycle management. Tokens should be created using cryptographically secure random number generators to ensure they are both unique and unpredictable. Format-preserving tokens are particularly useful, as they reduce the need for system modifications.

Tokenization also helps streamline compliance. By tokenizing Primary Account Numbers (PANs), businesses can limit the scope of sensitive data, reducing the number of systems subject to full PCI DSS requirements. This segmentation not only simplifies compliance but also minimizes risk.

Lifecycle management is equally important. This involves tracking tokens from creation to expiration or revocation. Clear policies should be in place for refreshing or retiring tokens, particularly after security incidents. Regular reviews of access permissions ensure they align with current business needs.

Integrating tokenization into your existing POS infrastructure requires careful planning. Partner with payment processors that offer built-in tokenization and real-time transaction monitoring to maintain smooth operations. Collaboration with your technical team is essential to ensure that tokenization services are implemented without disrupting daily workflows.

Lastly, invest in staff training. Your team should understand how tokenization safeguards customer data and be prepared to handle any issues that arise. Comprehensive testing of the tokenization system – covering normal transactions, error handling, and recovery processes – ensures a secure and seamless transition to this enhanced security model.

sbb-itb-5a88851

Encryption vs. Tokenization: Which to Choose

Encryption and tokenization each play distinct roles in data protection, and choosing between them depends on your specific data needs and compliance requirements. By understanding their strengths and limitations, you can make an informed decision for your POS system.

Pros and Cons of Each Method

Both methods offer unique advantages, but they also come with certain trade-offs.

Encryption is designed to secure data both at rest and in transit. It’s especially useful for situations where data must be processed in its original form. For instance, if your POS system requires real-time data analysis, encryption enables you to decrypt the data when necessary while keeping it secure during storage and transmission.

That said, encryption alters the data format, which may require adjustments to your system during implementation. Additionally, managing encryption keys is critical – if a key is compromised, all associated data could be exposed.

Tokenization, on the other hand, eliminates sensitive data from your environment. Tokens are randomly generated and have no connection to the original data, making them useless to hackers. This approach greatly simplifies PCI DSS compliance by removing sensitive data from your systems.

However, tokenization primarily protects data at rest. Unlike encryption, retrieving the original data for processing requires access to a secure token vault, which can make it less practical for scenarios requiring frequent access to the actual data.

One of tokenization’s key advantages is its ability to preserve the original data format. For example, a 16-digit credit card number is replaced with a 16-digit token, allowing your existing databases and applications to function without structural changes. In contrast, encryption often produces output that differs from the original format, potentially complicating integration.

When it comes to compliance, the two methods also differ. Tokenization reduces the scope of PCI DSS requirements by removing sensitive data from your environment entirely. Encryption, while compliant with regulations, still treats encrypted data as sensitive, which means it remains subject to strict standards.

Comparison Table: Encryption vs. Tokenization

| Factor | Encryption | Tokenization |

|---|---|---|

| Reversibility | Reversible with the correct key | Irreversible without access to the token vault |

| Data Format | Alters the original data structure | Preserves the original data format |

| Security Focus | Protects data at rest and in transit | Primarily protects data at rest |

| Compliance Impact | Helps meet requirements but doesn’t isolate sensitive data | Removes sensitive data from the environment, simplifying compliance |

| Key Management | Requires secure key storage and rotation | No key management needed |

| Best Use Cases | Data requiring processing in its original form | Data that needs referencing but not revelation |

| Integration Complexity | May require system modifications | Easier integration due to format preservation |

| Performance Impact | Encryption/decryption processing overhead | Minimal performance impact after implementation |

By reviewing these factors, you can tailor your POS security strategy to fit your operational needs.

Choosing the Right Approach for Your System

As mentioned earlier, a hybrid approach often provides the best results. For example, you might use tokenization to handle highly sensitive data, like payment details, while relying on encryption for data that requires frequent analysis or processing.

For high-volume, storage-focused scenarios, tokenization is increasingly becoming the go-to method. With tokenized payment transactions expected to exceed one trillion globally by 2026, its popularity in payment processing continues to grow.

Your existing infrastructure is another critical factor to consider. If your systems are already optimized for encrypted data, implementing additional encryption might be straightforward. Conversely, if you’re working with older systems that struggle with changes to data format, tokenization’s ability to preserve format could save you time and money during integration.

Ultimately, the choice between encryption and tokenization comes down to balancing security, compliance, operational complexity, and business goals. Many organizations find success by combining both methods, leveraging each where it delivers the most value.

Using MerchantWorld for Advanced POS Security

MerchantWorld takes POS security to the next level by integrating advanced technology with encryption and tokenization. Tailored for small and mid-sized businesses, the platform safeguards customer payment data at every step of the transaction process.

Advanced Technology and Built-in Security

MerchantWorld’s Clover POS systems and Valor standalone terminals are designed with built-in security features that automatically protect card data from the moment a customer swipes or inserts their card until the payment is completed. For instance, the Clover Station Pro ensures end-to-end encryption and tokenization throughout transactions while offering durable and efficient hardware. Encryption shields card data as it travels across networks, while tokenization replaces sensitive information with unique, non-sensitive tokens, easing the burden of PCI DSS compliance.

The platform also includes EMV chip reader terminals, adding another layer of security. Plus, it supports modern payment methods, ensuring secure transactions across all channels. These features not only protect sensitive data but also improve operational efficiency.

Features That Simplify Business Operations

MerchantWorld goes beyond security by streamlining business operations. Its 0% credit card processing solution eliminates processing fees through a cash discount program, addressing a common pain point for businesses while maintaining high security standards.

The platform’s merchant analytics tools, built to work seamlessly with encrypted and tokenized data, help businesses track sales trends, manage inventory, and analyze customer behavior – all while keeping payment information secure. Gift and loyalty programs also utilize tokenization to safely store customer data, and the online restaurant ordering feature extends these security measures to digital transactions.

With same-day approval and next-day funding, businesses can quickly access these features. Additionally, its cloud-based receipt system securely stores transaction histories using tokenized data, eliminating the need to store sensitive details.

24/7 Support and Compliance Assistance

Staying PCI DSS compliant is a continuous process, and MerchantWorld offers round-the-clock customer support to help businesses navigate it. Many businesses face challenges in maintaining full PCI compliance, making expert guidance essential.

MerchantWorld’s support team provides ongoing monitoring and sends timely reminders to help merchants stay on track with compliance requirements. They assist with tasks like completing the Self-Assessment Questionnaire (SAQ) and offer practical advice on implementing multi-factor authentication, conducting login audits, and strengthening security policies. With 97% of top U.S. retailers experiencing third-party data breaches in the past year, having 24/7 support for monitoring and incident response is critical. This proactive approach complements the platform’s encryption and tokenization measures, ensuring businesses remain protected and compliant while fostering customer trust.

Conclusion: Secure Your POS with Encryption and Tokenization

Protecting payment data through encryption and tokenization is more important than ever, especially as tokenized transactions are projected to surpass one trillion globally by 2026.

Encryption safeguards sensitive data both in transit and at rest, using protocols like AES, while tokenization replaces sensitive information with non-sensitive tokens. To maintain a strong defense, businesses should prioritize regular software updates, train staff on data security practices, and conduct routine security audits. Restricting employee access to essential system components and creating detailed incident response plans can further enhance overall security. This layered approach not only protects sensitive data but also ensures smoother business operations.

Modern POS systems go beyond security by improving efficiency and reducing errors, with integrated solutions driving operational improvements of 15–20%.

Take MerchantWorld as an example. Their Clover POS systems and Valor standalone terminals seamlessly blend advanced security features like encryption and tokenization with tools that enhance business operations. These include merchant analytics, gift and loyalty programs, and 24/7 customer support. Plus, with same-day approval and next-day funding, businesses can adopt these solutions swiftly without compromising speed or efficiency. This combination of robust security and operational functionality highlights the power of integrated POS systems.

FAQs

How do encryption and tokenization work together to improve POS security, and when should businesses implement both?

Encryption and tokenization work together to bolster POS security by layering multiple defenses. Encryption protects sensitive payment information by converting it into unreadable code during transmission, ensuring that intercepted data is useless to unauthorized parties. Meanwhile, tokenization adds another layer of safety by replacing actual payment details with a unique, non-sensitive token. This token can be securely stored or used in transactions without revealing the original data.

For businesses handling payment information, using both encryption and tokenization is a smart move – not just to meet PCI DSS compliance standards but also to minimize the risk of data breaches. This dual-layered strategy ensures that even if one measure is compromised, the other remains intact, safeguarding sensitive details and providing reassurance to both merchants and their customers.

What should I look for in a tokenization provider to secure my POS system?

When choosing a tokenization provider for your POS system, make security compliance your top priority. Look for providers that adhere to standards like PCI DSS and ISO/IEC 27001 to ensure your data is well-protected. Features like end-to-end encryption, role-based access controls, and frequent security updates are critical for reducing fraud risks and keeping sensitive information safe.

It’s also important to assess how reliable and effective their tokenization process is. The system should securely replace cardholder data with tokens that can’t be reversed. Opt for a provider with a solid history of compliance and advanced security measures to protect both your business and your customers’ data.

What are the best practices for using encryption and tokenization in POS systems to stay PCI DSS 4.0 compliant?

To keep your POS system aligned with PCI DSS 4.0 while using encryption and tokenization, focus on bolstering security and reducing potential risks. Start by using advanced cryptographic algorithms to encrypt sensitive cardholder data. Pair this with securely storing tokens in centralized, well-protected vaults. This way, even if data gets intercepted, it becomes useless to anyone without proper authorization.

Another key step is to limit the amount of cardholder data your system stores or processes. This reduces the scope of PCI DSS requirements and minimizes exposure. Make it a habit to regularly check your encryption and tokenization systems for any vulnerabilities. When updates or patches are available, apply them without delay. Implementing strict access controls is equally important to ensure only authorized personnel can access sensitive information.

By adopting these measures, businesses can safeguard customer data while staying compliant with PCI DSS 4.0, fostering a secure and reliable payment environment.