Want faster access to your sales revenue? Clover POS offers a next-day funding feature that ensures your funds are deposited within one business day after transactions are settled. This helps businesses manage cash flow effectively, meet financial obligations, and reduce delays caused by weekends or holidays.

Here’s a quick breakdown of what you need to get started:

- Enroll with MerchantWorld: Sign up for their 0% credit card processing program, which includes next-day funding.

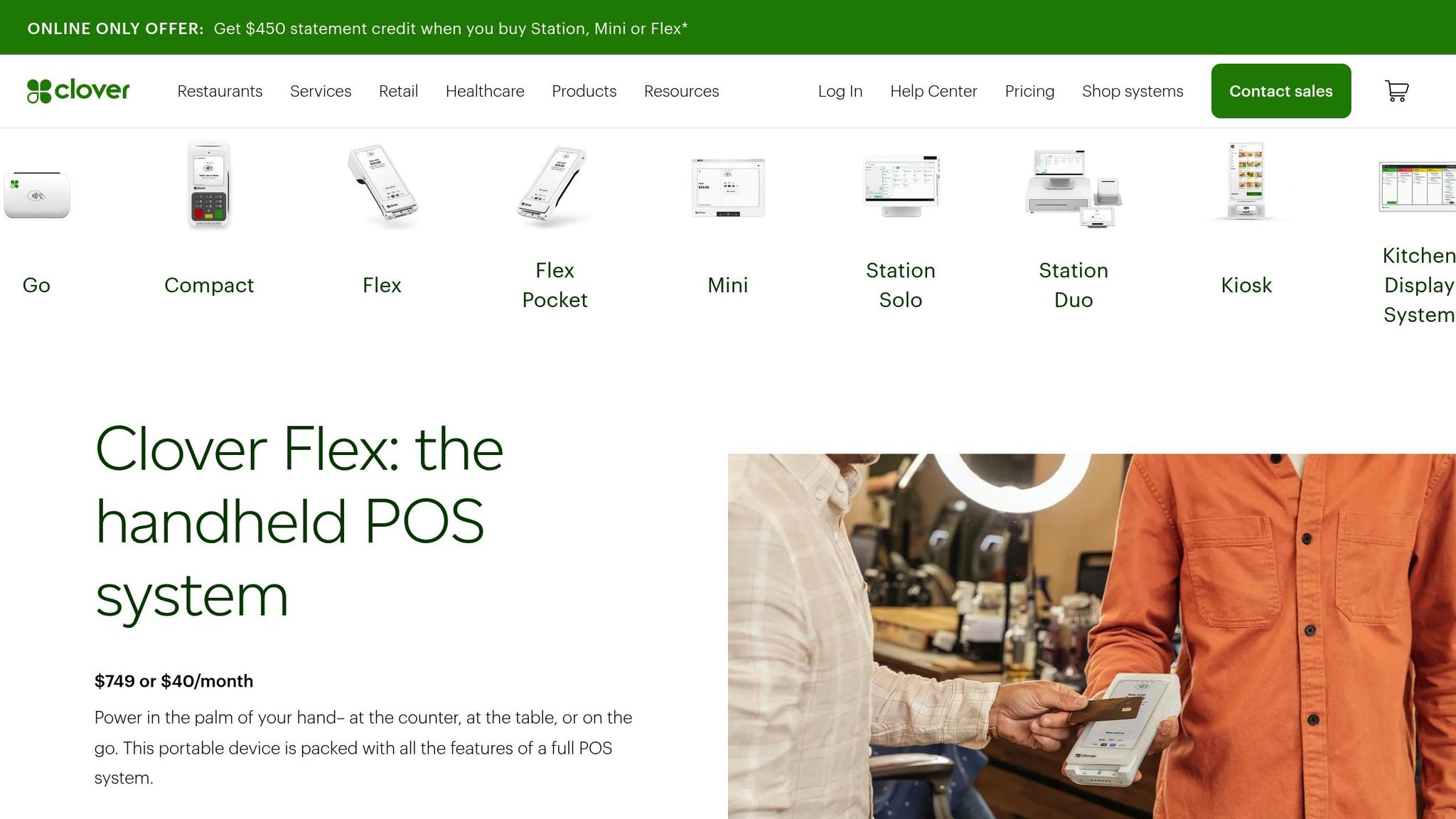

- Set up Clover POS hardware: Use compatible devices like the Clover Station Pro, Mini, or Flex.

- Link a business bank account: Ensure it supports ACH deposits and matches your business details.

- Complete verification: Provide required documents like your EIN and bank details for approval.

- Optimize closeout settings: Adjust closeout times and enable auto-closeout to ensure timely processing.

Clover Point of Sale – Clover Tutorial – Account Hardware and Software Clover Flex, Clover Duo

Requirements for Setting Up Next-Day Funding

Next-day funding can be a game-changer for businesses, but there are specific steps you’ll need to follow to get everything set up properly. Here’s what you’ll need to ensure a smooth integration of your Clover POS system with MerchantWorld’s next-day funding program.

MerchantWorld Account Setup

The first step is to enroll in MerchantWorld’s 0% credit card processing program, which includes next-day funding as part of the package. To begin, fill out an application with your business details and agree to the terms. During this process, make sure to select next-day funding as your preferred settlement option. MerchantWorld offers same-day approval, so you won’t be stuck waiting weeks to get started. Once approved, you’ll have access to advanced payment solutions and the next-day funding feature.

Compatible Clover POS Hardware

To enable next-day funding, you’ll need a supported Clover device. Compatible models include the Clover Station, Mini, Flex, Go, and Duo. MerchantWorld simplifies this by offering the Clover Station Pro at no upfront cost when you enroll in their 0% credit card processing program. This system comes fully equipped with a 14-inch touchscreen, integrated cash drawer, barcode scanner, and customer display. Make sure your device is properly installed, activated, and connected to the internet. A stable connection is critical – without it, transactions might not process correctly, potentially delaying funding. While there’s no upfront cost for the hardware, you’ll need to account for a monthly Clover Services fee of $54.95.

Business Bank Account Setup

You’ll need a U.S.-based business checking account that supports ACH deposits. Personal accounts won’t work here – the account must be registered under your business’s legal name and match the details you provide during MerchantWorld’s onboarding. To minimize transfer delays, it’s a good idea to consolidate your payment processing and deposit accounts at the same bank. Double-check that all account details are accurate, as even minor inconsistencies can cause delays or prevent approval.

Complete Underwriting and Verification

The final step involves MerchantWorld’s underwriting process, which ensures your business meets their standards for next-day funding. You’ll need to provide essential information and documents, including your legal business name (as registered), EIN (Employer Identification Number), owner identification, business address, and bank account details. Additional documents may include a voided check from your business account, your business license, and recent bank statements. MerchantWorld will review everything to confirm compliance with their requirements, considering factors like your business type, expected transaction volume, and risk level. Incomplete or inaccurate submissions are the most common cause of delays, so it’s crucial to double-check everything before submitting. Once approved, you’ll be ready to start benefiting from next-day funding through your Clover POS system.

Step-by-Step Guide to Configure Clover POS for Next-Day Funding

Once you’ve met all the necessary requirements, it’s time to set up your Clover POS system for next-day funding. Follow these steps to go from initial setup to enabling automated batch processing.

Activate and Set Up Your Clover Device

Start by powering on your Clover device and connecting it to a reliable network. Log in using your MerchantWorld credentials, then complete the registration process by setting your time zone and business hours. Make sure the business details you enter match the information you provided during underwriting. Afterward, link your bank account to proceed.

Link Your Business Bank Account

Access your Clover Dashboard either through your POS system or the web portal at clover.com. Go to Account & Setup and select Banking Information. Enter your routing and checking account numbers carefully, then verify ownership using micro-deposits or instant verification.

To speed up funding, consider using the same financial institution for both your deposit account and payment processing. Doing so could reduce the time it takes for funds to reach your account by up to 24 hours. If your payment processor and bank are already the same, this might further minimize delays. Once your account is linked, verify your eligibility for next-day funding to finalize the setup.

Verify Eligibility for Next-Day Funding

Reach out to MerchantWorld’s 24/7 support team to confirm that your account is correctly configured for next-day funding. During this step, the support team will ensure your business type, transaction volume, and risk profile align with the requirements for next-day funding. They can also assist you in optimizing your system settings for faster deposits.

Adjust Closeout Time Settings

Go to Account & Setup > Closeout Settings and set your closeout time to shortly after your business hours. This step ensures early batch settlement, which is crucial for next-day funding.

By default, the system uses a 1:00 a.m. closeout time. However, adjusting this to align with your actual business hours can make a difference. For example, if your business closes at 9:00 p.m., setting your closeout time to 10:00 or 11:00 p.m. can help speed up settlement, reducing the likelihood of waiting an extra business day for your deposits.

Enable Auto-Closeout

Turn on the auto-closeout feature to maintain consistent next-day funding. This setting eliminates the need for manual closeouts, ensuring your transactions are processed and settled automatically at the time you specify. Choose a closeout time that reflects when your daily operations end to keep everything running smoothly. Automating this step helps reduce errors and ensures a reliable funding schedule.

If you’re unsure about optimizing your system for next-day funding, MerchantWorld’s support team is available to guide you through the process.

After completing these steps, test your setup by processing a small transaction. Wait for your configured closeout time, then check your bank account the next business day to confirm that the funds were deposited as expected.

sbb-itb-5a88851

Troubleshooting and Best Practices

Even when everything is set up correctly, next-day funding can sometimes hit snags. To keep your cash flow steady, follow these practical tips.

Understanding Bank Holidays and Delays

Next-day funding only applies to business days. For example, if you close your batch on Friday evening, don’t expect funds until Monday. And if there’s a federal holiday on Monday, your deposit will arrive on Tuesday instead [3,6].

Federal holidays that commonly delay funding include:

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents’ Day

- Memorial Day

- Independence Day

- Labor Day

- Columbus Day

- Veterans Day

- Thanksgiving

- Christmas Day

Make sure to factor these dates into your cash flow planning. Weekend transactions are also affected. A Saturday night sale processed in your Sunday batch won’t show up in your account until Tuesday at the earliest. Keeping this timeline in mind helps you prepare for expenses like payroll or vendor payments.

Optimize Closeout Timing

The timing of your closeout can significantly impact when your funds are deposited. Clover systems default to a 1:00 a.m. closeout, but this timing may push your transactions into the next business day’s processing cycle [3,4].

To avoid delays, set your closeout time closer to your actual closing time. For instance, if your business closes at 10:00 p.m., schedule your closeout for 10:30 p.m. or 11:00 p.m. This ensures your transactions are included in the current business day’s batch.

Another tip: consider using the same financial institution for both your deposit account and payment processing. This can shave up to 24 hours off transfer times since the funds don’t need to move between banks.

Verify Account and Business Details Regularly

Outdated or incorrect account details are a common cause of funding delays. Make it a habit to check that your business name, bank account, and routing numbers in the Clover dashboard (Account & Setup > Banking Information) match your bank records.

If you switch banks, change your business structure, or update your legal name, update this information immediately. A mismatch between your registered business name and bank account name can lead to rejected deposits and compliance holds, delaying funding by several days.

Also, double-check your time zone settings. An incorrect time zone may cause your closeout to occur later than intended, pushing your transactions into the next day’s batch and delaying your funds by 24 hours. If problems persist even after verifying your details, MerchantWorld’s expert support team is there to help.

MerchantWorld’s 24/7 Support

When something goes wrong, MerchantWorld’s 24/7 support team is your go-to resource. They can help verify account settings, troubleshoot closeout timing issues, and resolve technical problems quickly.

Reach out if your next-day funding suddenly stops working, if funds don’t appear within the expected timeframe, or if you need assistance optimizing your system settings. The support team can also confirm your eligibility for next-day funding and guide you through any necessary updates to your account.

For businesses using MerchantWorld’s Clover Station Pro at $54.95 per month, this round-the-clock support is included in your service plan. It’s a valuable resource, especially during busy times when cash flow issues can disrupt operations.

Keep MerchantWorld’s support contact information handy. Quick access to knowledgeable assistance can turn a potential crisis into a minor inconvenience, ensuring your business runs smoothly even during challenging periods.

Conclusion and Key Takeaways

Why Next-Day Funding Matters

Next-day funding changes the game for small and mid-sized businesses by offering quicker access to cash. Instead of waiting the usual 2-3 days for credit card sales to process, funds hit your account the very next business day. This accelerated cash flow can be a lifesaver, helping you cover essential expenses like payroll or restocking inventory without the stress of delays.

The impact goes beyond convenience. Imagine landing a big sale on a Monday and having those funds ready to use by Tuesday morning. Whether you need to reinvest in your business, bring on new team members, or extend your hours, this kind of flexibility helps you stay nimble and tackle unexpected costs head-on. However, to make the most of these benefits, setting up your system correctly is absolutely crucial.

How to Get Started

Getting next-day funding up and running smoothly requires attention to detail. Configuring closeout times, linking your bank account properly, and enabling auto-closeout features are key steps to ensure consistent, hassle-free access to your funds.

What MerchantWorld Brings to the Table

MerchantWorld takes next-day funding to another level by combining it with 0% processing fees. How? By embedding the processing costs into your sales prices, you get to keep 100% of your revenue while still enjoying fast cash flow.

But that’s not all. MerchantWorld offers same-day approval and 24/7 customer support to get you set up quickly and keep things running smoothly. Their advanced technology and personalized service ensure your funding process is seamless. Plus, with their cash discount program and modern payment solutions, your business can cut costs and improve cash flow management, giving you a real edge in the market.

FAQs

What are the advantages of using next-day funding with Clover POS for my business?

Next-day funding with Clover POS gives businesses quicker access to their funds, making it easier to manage cash flow and keep daily operations running smoothly. Whether it’s covering expenses, replenishing stock, or dealing with surprise costs, having access to revenue the next day can make a big difference.

With this feature, businesses can prioritize growth and delivering great customer experiences instead of stressing over payment delays. It’s a dependable way to keep financial management on track.

How can I set up my Clover POS system to ensure next-day funding?

To get your Clover POS system ready for next-day funding, it’s important to ensure your account settings are properly configured. Start by verifying that all your business and banking information is accurate and current – this helps prevent any unnecessary delays in processing.

If you’re working with MerchantWorld, you’ll have access to their advanced payment processing tools, which include next-day funding. Their support team can guide you through the setup process and make sure your system is running smoothly for quick and dependable transactions.

Why might my next-day funding be delayed, and how can I resolve it?

If your next-day funding doesn’t arrive as expected, it’s usually due to a bank holiday or incorrect account details. Bank holidays can pause transfers temporarily, while errors in your account information might stop the deposit from going through.

To fix this, start by double-checking your account details to make sure everything is accurate and current. If a bank holiday caused the delay, your funds will likely show up on the next business day. Need help? MerchantWorld offers 24/7 customer support to quickly address any issues or concerns.